31+ mortgage payment rule of thumb

Apply Now With Quicken Loans. Web 2150 - 450 1700 maximum total monthly mortgage payment including principal interest taxes and insurance 28 Housing Payment Rule.

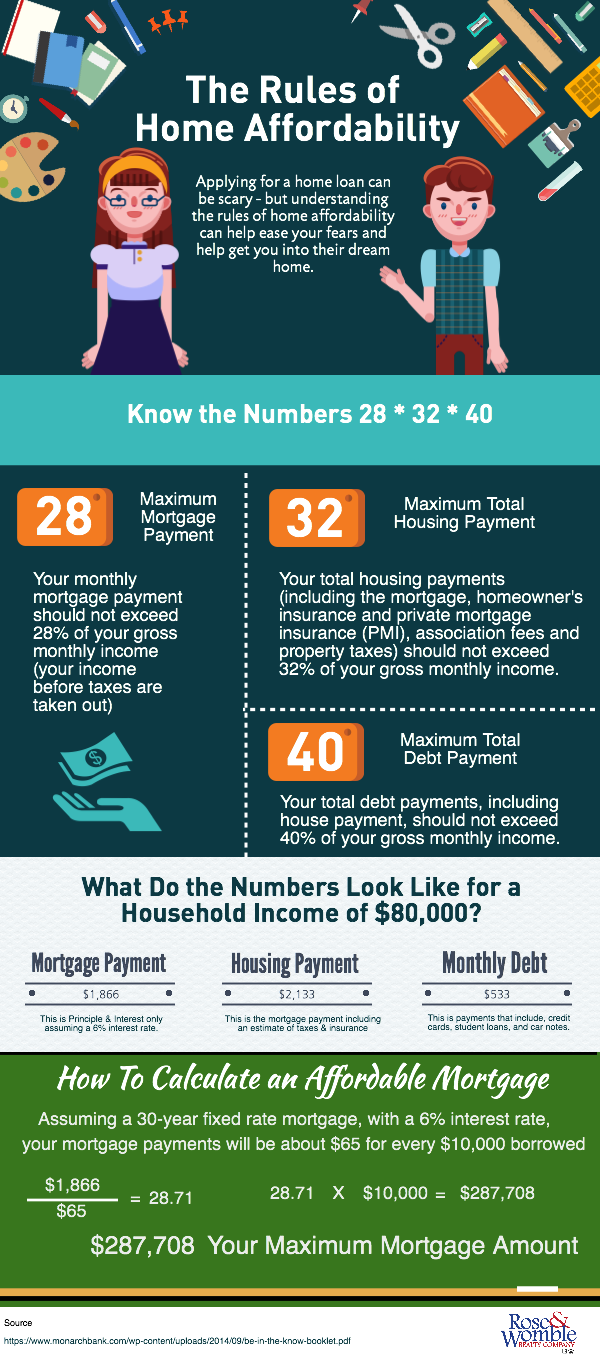

Mortgage School The Rules Of Home Affordability Rose Womble Realty Co

Comparisons Trusted by 45000000.

. Web The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg. Web A good rule of thumb is that the front-end ratio based on PITI should not exceed 28 of your gross income. Get Your Quote Today.

Web The 32 rule covers all of your financial obligations such as mortgage payments homeowners insurance property taxes homeowners association fees etc. Ad Compare Mortgage Options Calculate Payments. Ad Review 2023s Top Rated Home Lenders.

However many lenders let borrowers exceed 30. Lock Your Mortgage Rate Today. Web To calculate how much house can I afford one rule of thumb is the 2836 rule which states that you shouldnt spend more than 28 of your gross monthly income on home.

X 100000 290000 Ideally you have a down. Trusted VA Home Loan Lender of 300000 Military Homebuyers. Contact a Loan Specialist.

Comparisons Trusted by 45000000. Web The rule is simple. Web What is the mortgage affordability rule of thumb.

Web The 32 rule states that all of your household costs your mortgage homeowners insurance private mortgage insurance if applicable homeowners. Web The most common rule of thumb to determine how much you can afford to spend on housing is that it should be no more than 30 of your gross monthly income. A 30-year fixed-rate mortgage at 35 interest and 3 down would result in a monthly principal and interest.

Ad Review 2023s Top Rated Home Lenders. Were Americas Largest Mortgage Lender. VA Loan Expertise and Personal Service.

Web Lets look at an example using a 250000 home. Maximum household expenses wont exceed 28 percent of your gross monthly income. Principal interest taxes and insurance.

Web Lenders usually require the PITI principle interest taxes and insurance or your housing expenses to be less than or equal to 25 to 28 of monthly gross income. Web The 2836 rule refers to how much debt you can take on and still be approved for a conforming mortgage which is what you may think of as a normal mortgage that. When considering a mortgage make sure your.

The mortgage affordability rule of thumb states that no more than 35 per cent of your post-tax income. Web For the couple making 80000 per year the Rule of 28 limits their monthly mortgage payments to 1866. The key is to.

Web The 2836 rule is a rule of thumb for managing your finances and a valuable tool in determining how much house you can affordThe rule says that you should.

Pdf The Changing Landscape Of Retirement Rules Of Thumb

31 Sample Business Credit Applications In Pdf Ms Word

31 Sample Business Credit Applications In Pdf Ms Word

Use The 30 30 3 Rule To Figure Out What House You Can Afford

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Decide How Much Home You Can Afford With The 25 Rule Of Thumb

Can You Afford That House The 30 Rule Explained Walletgenius

List Of Top Financial Services Companies In Bhavani Best Finance Companies Justdial

31 Money Receipt Templates Doc Pdf

How Much Of My Income Should Go Towards A Mortgage Payment

How Much House Can You Afford Calculator Cnet Cnet

30 Best Business Accountants In Melbourne Victoria 2023

![]()

3 Powerful Lessons From My Real Estate Portfolio After 7 Years

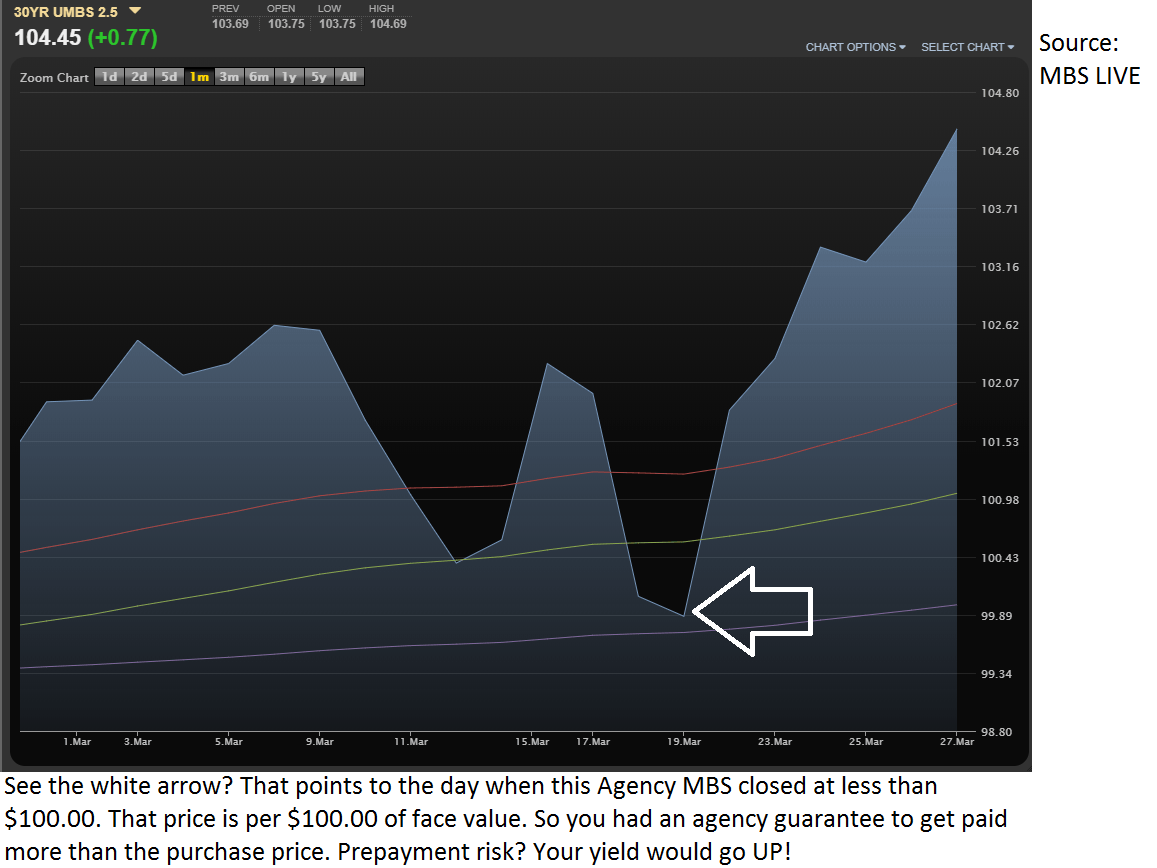

How Banks Damaged Mortgage Reits Seeking Alpha

:max_bytes(150000):strip_icc()/avoiding-bad-home-layout-1798346_final-92e4aab4fe7d4913ac1493d24fc8267f.png)

What Is The 28 36 Rule Of Thumb For Mortgages

How Much House Can You Afford The 28 36 Rule Will Help You Decide

North York Post December 2022 By Post City Magazines Issuu